Stock Market Psychology Chart: Your Emotional Investing Compass

Dec 10, 2025

Introduction: Where Emotion Writes the Tape

The market is not a classroom. It is a behavioural arena where money reacts long before minds catch up. Data drifts in as camouflage, but the real signals fire from instinct. Fear jerks liquidity into hiding. Greed drags it into the open. Every rally, every collapse, every violent pivot begins with an emotional tremor that the Stock Market Psychology Chart captures with unnerving precision.

This chart does not offer comfort. It exposes the pulse beneath the price. Despair tightens volatility until the tape can barely breathe. Euphoria spreads apart as traders sprint toward fantasy. In March 2009 the AAII survey showed seventy per cent bearish sentiment while the VIX surged above eighty and breadth collapsed. That emotional saturation marked the beginning of a decade-long climb. In late 2021, the opposite hit. Confidence pulsed above sixty per cent while liquidity velocity stalled. The divergence was visible. The crowd refused to see it. Three months later, the Nasdaq lost more than thirty per cent.

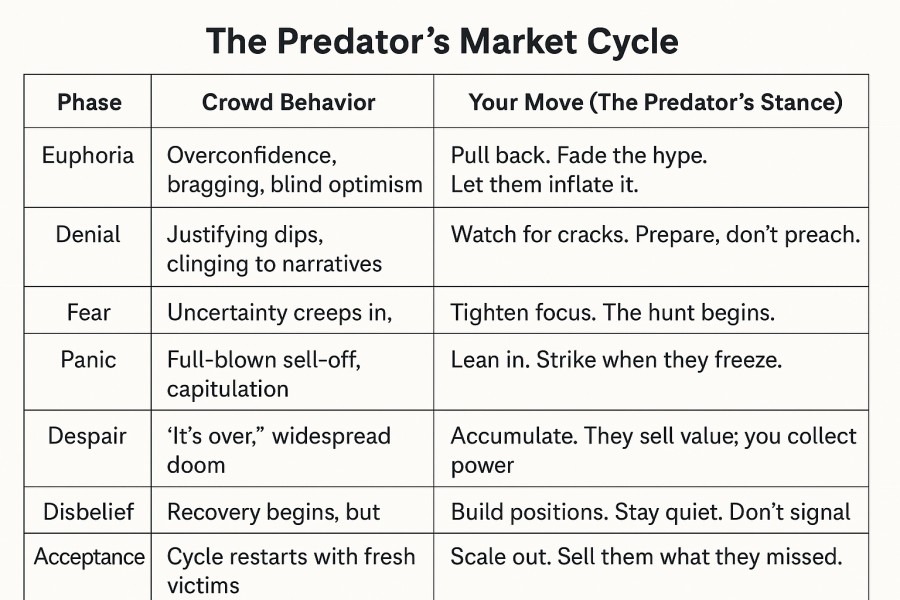

Old thinkers understood this pattern long before screens existed. Mackay chronicled how entire societies surrendered judgment in waves of fear and hope. Confucius warned that others will rule a person who cannot govern himself. In markets, those “others” are not sages. They are crowds locked into the same cycle: panic, capitulation, disbelief, optimism, thrill, euphoria, complacency, anxiety, denial, panic again. The pattern repeats because human wiring does not update with each crash.

The Stock Market Psychology Chart is not a prophecy. It is a radar. It reveals the emotional front moving through the system before the chart reflects it. Once you understand that, you stop dancing to the herd’s rhythm. You begin to set the rhythm yourself. That is the pivot point where prey becomes predator.

Crowd positioning follows a coarse emotional cycle that spirals more than it marches. You can trace it like a weather front:

panic → capitulation → disbelief → optimism → thrill → euphoria → complacency → anxiety → denial → panic. The pattern repeats because the wiring stays the same. Biology does not update with the chart.

What It Shows

✅ Each stage represents a dominant emotional state that shapes investor behaviour—regardless of valuation.

From stealth accumulation and disbelief to euphoria and capitulation, this cycle captures the predator-prey dynamics of market psychology.

Core Emotional Signals

Euphoria = herd blindness. The top is near.

Despair = crowd collapse. Opportunity is forming.

Hope = denial in disguise.

Neutrality above 55%? That’s not balance. That’s a crowd cracking from within—a freeze before the quake.

Contrarians don’t avoid these zones—they hunt them.

Weaponising Sentiment: From Bias Trap to Tactical Edge

Most traders worship data. Few question the source of that data—human emotion. Fear, greed, hope, denial—they’re the fuel behind every chart spike and crash.

Stock market psychology charts expose this madness in motion. They’re not just visual tools—they’re extraction maps for the contrarian operator. Properly wielded, they help you:

Cut through noise by tracking sentiment evolution—not price action alone.

Detect reversals early when crowd emotion hits unsustainable highs or lows.

Spot hidden cracks—like rising optimism despite weakening technicals.

Avoid classic pitfalls such as overconfidence, herd mentality, and FOMO.

Trigger bold contrarian plays just as the herd throws in the towel.

Extreme Greed? Signal to prep your exit.

Panic? Likely near a bottom.

Neutral above 55%? Don’t get fooled. That’s not indecision—it’s psychological pressure cracking from within. That’s when real shifts begin.

Anxiety Index hitting extremes? You’re standing at the inflexion point. Direction depends on how deeply fear has rooted.

Stop Trading Blind

Overconfidence shows up as low volatility, bullish surveys, and an eerie absence of caution. These aren’t signs of strength—they’re precursors to collapse.

If the chart shows euphoria detached from fundamentals, tighten risk. Lighten up into overbought highs. The crowd’s certainty is your cue to become uncertain.

And when the data screams fear, when media panic surges, when put/call ratios spike, and everyone’s screaming “sell”: Be ready for it’s time to start sharpening your blades.

Rules of the Game

Markets are psychological arenas where survival belongs to the few who can think, while everyone else feels. One signal is never enough. Two is better. Three—sentiment, technicals, macro—is your shield. Ask the dangerous question: What does the crowd believe, and what if they’re dead wrong?

Never sprint into trades. Stagger your entries. Use stops like a surgeon uses clamps. Expect fakeouts; they are the market’s way of filtering amateurs. Your mission is not perfection—it’s endurance. Size like a professional. Know exactly how much red you can bleed before the trade poisons your capital.

Charts don’t lie, but people do—most brutally to themselves. The best traders don’t just read patterns; they read delusions. They don’t chase trends. They stalk the minds, manufacturing them.

Why This Matters

A stock market psychology chart is not a decoration. It’s a contrarian’s compass, a real-time map of emotional extremes that price hasn’t yet fully priced. When paired with tools like an Anxiety Index, it detects stress fractures in crowd sentiment long before they rupture on the chart.

John Templeton’s dictum is timeless: “Bull markets are born on pessimism… and die on euphoria.” Your job is to spot the funeral before the crowd even orders a single flower. That means tracking when sentiment slips beneath despair and when optimism bloats into terminal euphoria. Neutral sentiment above 55 per cent? That’s not calm—it’s the fracture before the break.

Inside the Psychology Chart: Decoding the Crowd’s Pulse

“To master the market, one must first master fear.” Markets are battlegrounds of emotion disguised as spreadsheets. The crowd panics at the bottom and cheers at the top, laying breadcrumbs for the strategist.

The fear zone is the point of capitulation. Volume spikes, sentiment collapses, support stabilises. Investors dump shares in despair. That’s when predators step in. Accumulation happens quietly, while CNBC plays dirges. Hope fuels rebounds, greed drives manic bidding, and euphoria blinds. Then comes complacency, then gravity. The cycle is as old as commerce, and it repeats because human nature doesn’t update.

Historical data is brutal and clear:

- 2009: Sentiment readings hit extreme bearishness as the S&P 500 bottomed near 666. Those who bought, then saw a decade-long rally.

- March 2020: AAII sentiment hit a 30-year bearish extreme while VIX breached 80. Indices doubled within 18 months.

- Dot-com bubble 2000: Bullish sentiment lingered above 65% for months; the Nasdaq lost nearly 80% afterwards.

Market Psychology: The Real Signal Behind the Price

The market doesn’t move on rational models. It twitches on hormones—dopamine in euphoria, cortisol in panic. A psychology chart distils these oscillations into a visual language. It shows where the herd will act before it does.

Panic isn’t danger; it’s liquidation on sale. Despair is the birthplace of generational wealth—but only for those who can act when it feels like death. Euphoria isn’t success; it’s the final hallucination before collapse. Most investors buy the hallucination and sell the despair. Professionals do the opposite—with discipline, not hope.

The Market Is a Mind Game—Master It or Be Played

The crowd panics. The crowd cheers. But the market? It listens to neither. It hunts emotional weakness with surgical patience. It rewards mental clarity and punishes hormonal spasms. The psychology chart is not a tool. It’s a weapon. It maps the herd’s heartbeat, tells you when fear is ripe for exploitation, and when greed is about to implode under its own weight.

Seneca said, “He who is brave is free.” In markets, bravery is not swagger. It’s resisting your own biology. Michel de Montaigne added the final cut: “The greatest thing in the world is to know how to belong to oneself.” The real investor does not chase or flee. They measure. They wait. They strike.

The market doesn’t reward emotion—it exploits it. It crowns the few who stand still while others stampede. You can either track the herd’s footprints or track their vulnerability. There is no middle ground.

Panic hands you bargains. Euphoria hands you exits. Everything else is noise.

Conclusion: Trained by Whiplash

The market behaves like an organism shaped by shocks, sugar, and superstition. A CPI whisper, a hesitant comma in a Fed statement, a headline engineered for panic, and the crowd responds with the reflex of a creature that has forgotten how to think. Even the machines, built to transcend emotion, drift into the same ritual patterns Charles Mackay described nearly two centuries ago in Extraordinary Popular Delusions and the Madness of Crowds. Different century, same circuitry. The herd lunges, retreats, stampedes, then asks why the footprints never change.

Price does not tell a story. It records a mood. When greed climbs into fever or fear sinks into paralysis, fundamentals become ornaments hanging on a structural lie. Investors insist they are making decisions. What they are really doing is reenacting scripts traced long ago, from the South Sea frenzy to the 1929 break. The same swing, the same hysteria curve, the same denial. One look at the vectors in late 2021 made the pattern obvious. Liquidity velocity flattened, speculative participation peaked, and the NASDAQ levitated on fumes while traders congratulated themselves for conquering gravity. The tape had already turned. Three months later, the fall arrived on schedule.

The disciplined escape this cycle by marrying vector analysis with old truths the crowd keeps forgetting. Mackay documented how people abandon reason in groups. Richard Wyckoff mapped how large operators exploit that impulse by absorbing shares during panic and distributing them into euphoria. Put those frameworks beside modern sentiment and liquidity data, and the fog clears. You stop reacting to headlines. You start tracking impulse. You see the emotional fracture points before the chart breaks.

Buy high because a stranger on television smiled at the ticker, and you join a pilgrimage of the unprepared. Sell low because a voice cracked on financial news, and the market will stamp your receipt with a grin. The crowd follows the same ritual every cycle: chase noise, panic at the turn, rationalise the wreckage. They call each drawdown unprecedented, as if history has not been teaching the same lesson for 300 years.

Those who break the loop act where discomfort is loudest. March 2009 delivered despair readings unseen in a generation. Accumulators were not mystics. They were students of human panic. March 2020 gave VIX readings resembling cardiac arrest while Apple, Microsoft, and Nvidia traded at discounts only fear can produce. The buyers were not lucky. They were calm.

At Tactical Investor, we ignore the narrative theatre. We study the nervous system of the market: sentiment vectors, herd orientation, liquidity strain, and the shift from denial to capitulation. We watch behaviour, not commentary. The market is not chaos. It is patterned frenzy. It pulses the same way every cycle, even as the costumes change.

You either decode the conditioning and use it.

Or you become part of the ritual that someone else profits from.